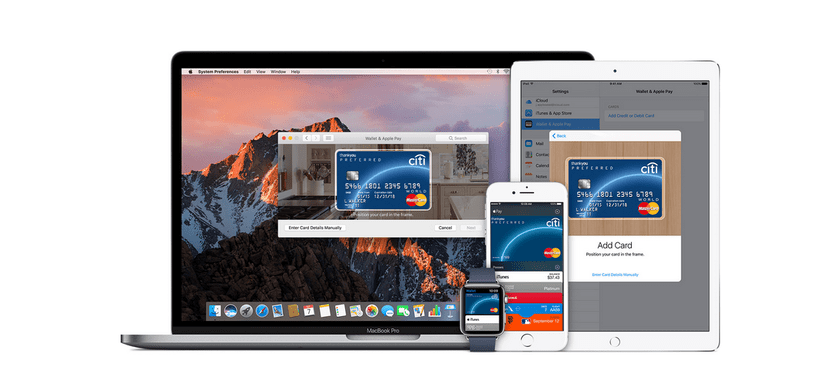

Australian banks stood up to the landing of Apple Pay in the country. Originally, they legally requested to be able to negotiate jointly, which would give them more strength than doing it separately, the commissions that the Cupertino company would charge them for integrating into their mobile payment system. However, an aspect that perhaps interested even more the large banks was the opening of the NFC of the iPhone and Apple Watch, which would also offer its own payment systems, direct competition from Apple Pay.

After Australian banks' demands to jointly negotiate on fees have been rejected by Australia's competition regulator, they are now focused exclusively on getting the NFC technology open for the iPhone and Apple Watch.

A lawsuit rejected, now banks are concentrating their efforts on having the NFC used by Apple Pay open

Australian banks Bendigo and Adelaide Bank, Commonwealth Bank of Australia, National Australia Bank and Westpac have 'put aside' negotiations on fees and charges, to focus their efforts on a clear argument: Access to Apple Pay's NFC technology would benefit retailers, boost loyalty programs, and enhance contactless payments overall.

Australian banks (meaning the big Australian banks) consider that there can be no 'genuine competition' in Australia if Apple is allowed to 'throttle' the market by allowing it to bring a closed system to the country's banks.

Open access to the NFC function, as in the most popular and widely installed Android mobile operating system, is important not only for applicants [retailers] and mobile payments, but for a number of NFC-powered functions in many industries and uses. This has global implications for the use of NFC on smartphones, Bank spokesman Lance Blockley said in a statement.

Applicants expect Apple Pay to be offered to their customers along with open access to the NFC feature. Any delay or frustration will be the result of Apple refusing to negotiateBlockley added.

Last year Bendigo and Adelaide Bank, Commonwealth Bank of Australia, National Australia Bank and Westpac jointly filed a complaint with the Australian Competition and Consumers Commission (ACCC) requesting to collectively negotiate access to NFC technology used by Apple Pay. . Although the final decision will not be known at least until next March, it seems that the banks will not achieve their goal.

For the moment, only one large national bank, the ANZ Banking Group, supports Apple Pay in Australia, although ING and Macquarie will also begin to be available in the country soon. In addition, other minor banking entities are already compatible with the apple payment system: Australian Unity, Catalyst Money, Customs Bank, Horizon Credit Union, Laboratories Credit Union Ltd., Nexus Mutual, Northern Beaches Credit Union, The Rock and UniBank.

A security problem?

Apple has insisted that allowing third parties access to your NFC technology would compromise security and that device owners would have to manually choose which application uses the chip, which could reduce adoption. Last Friday, Apple Vice President Jennifer Bailey pointed out that the legal confrontation has impeded reasonable negotiations on the conditions and advantages of the service.

While initially, in many markets, there have been banks that have initially been cautious when working with a company as large as Apple, once they start working with us and understand the Apple Pay platform, they see the benefits of it. That hasn't completely happened with ACCC applicants, because the conversation is happening through the ACCC process, compared to what normally happens, which is that we have the conversation bilaterally.

Additionally, Bailey noted that Australians are using Apple Pay more often than customers in any other country. Currently, more than 26% of ANZ's clients are using the platform.