Bankunan Ostireliya sun tsaya kan saukar Apple Pay a cikin kasar. Asali, sun nemi doka ta ba su damar yin shawarwari tare, wanda zai basu karfi fiye da yin shi daban, kwamitocin da kamfanin Cupertino zai caje su don shiga cikin tsarin biyan wayar su. Koyaya, wani yanayin da watakila ma yafi sha'awar manyan bankunan shine bude NFC na iPhone da Apple Watch, wanda shima zai bayar da nasa tsarin biyan kudi, gasar kai tsaye daga Apple Pay.

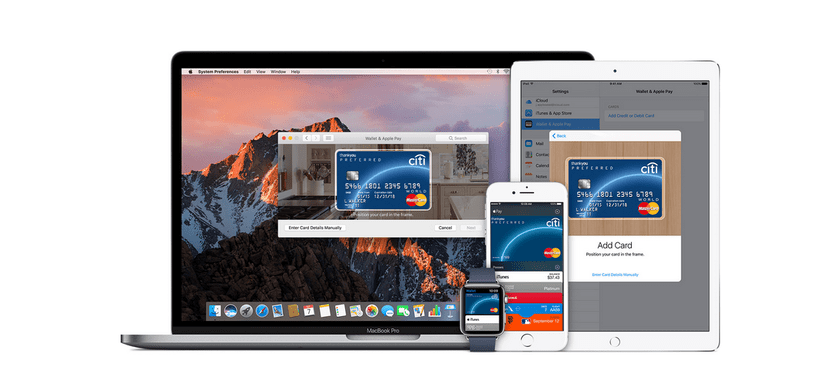

Bayan da bankunan Ostiraliya suka nemi yin shawarwari a kan kudaden tare wanda mai kula da gasar na Australiya ya ki amincewa da shi, yanzu sun mai da hankali ne kan bude fasahar NFC ga iPhone da Apple Watch.

An ƙi amincewa da wata kara, yanzu bankuna suna mai da hankali kan ƙoƙarinsu na ganin an buɗe NFC ta Apple Pay

Bankunan Australiya Bendigo da Adelaide Bank, Commonwealth Bank of Australia, National Australia Bank da Westpac sun 'ajiye' tattaunawar kan kudade da caji, don mai da hankali ga kokarinsu kan wata hujja bayyananniya: Samun dama ga fasahar NFC ta Apple Pay zai amfani yan kasuwa, bunkasa shirye-shiryen aminci, da bunkasa biyan mara lamba gaba daya.

Bankunan Australiya (ma'ana manyan bankunan Australiya) sun yi la'akari da cewa ba za a sami 'gasa ta gaske' ba a cikin Australiya idan aka bar Apple ya 'kayar' kasuwa ta hanyar ba shi damar kawo tsarin rufewa ga bankunan kasar.

Bude samun dama ga aikin NFC, kamar yadda yake cikin shahararriyar kuma babbar shigar da tsarin wayar hannu ta Android, yana da mahimmanci ba kawai ga masu nema ba [yan kasuwa] da biyan kuɗi, amma don yawancin ayyukan NFC masu ƙarfi a yawancin masana'antu da amfani. Wannan yana da tasirin duniya game da amfani da NFC a wayoyin hannu, Mai magana da yawun bankin Lance Blockley ya ce a cikin wata sanarwa.

Masu nema suna tsammanin za a ba da Apple Pay ga abokan cinikinsu tare da samun damar shiga fasalin NFC. Duk wani jinkiri ko takaici zai kasance sakamakon Apple ya ƙi tattaunawaBlockley ya kara.

A shekarar da ta gabata, Bendigo da Adelaide Bank, Commonwealth Bank of Australia, National Australia Bank da Westpac tare sun gabatar da korafi ga Hukumar Kula da Gasar Ciniki da Masu Ciniki ta Australia (ACCC) inda suka nemi a hada kai a tattauna hanyoyin samun fasahar NFC da Apple Pay ke amfani da su. Kodayake ba za a san shawarar karshe ba aƙalla har zuwa watan Maris na gaba, da alama bankunan ba za su cimma burinsu ba.

A yanzu, babban bankin kasa daya ne kawai, Kungiyar Bankin ANZ, ke tallafawa Apple Pay a Australia, kodayake ING da Macquarie suma za su fara samuwa a cikin ƙasar da sannu. Bugu da kari, sauran kananan hukumomin hadahadar banki sun riga sun dace da tsarin biyan kudin na apple: Hadin gwiwar Australiya, Kudin Kudi, Bankin Kwastam, Horizon Credit Union, Laboratories Credit Union Ltd., Nexus Mutual, Northern Beaches Credit Union, The Rock da UniBank.

Matsalar tsaro?

Apple ya nace cewa barin ɓangare na uku samun damar fasahar NFC ɗinka zai lalata tsaro kuma masu mallakan na'urar zasu zabi da hannu ne wacce aikace-aikace take amfani da ita, wanda zai iya rage tallafi. A ranar Juma’ar da ta gabata, Mataimakin Shugaban Kamfanin Apple, Jennifer Bailey ya nuna hakan takaddamar shari'a ta hana tattaunawa mai ma'ana kan yanayi da fa'idodi na sabis ɗin.

Duk da yake da farko, a kasuwanni da yawa, akwai bankuna waɗanda da farko suke yin taka tsantsan yayin aiki tare da kamfani mai girma kamar Apple, da zarar sun fara aiki tare da mu kuma sun fahimci tsarin Apple Pay, suna ganin fa'idar hakan. Hakan bai gama faruwa da masu neman ACCC gaba daya ba, saboda tattaunawar na faruwa ne ta hanyar tsarin ACCC, idan aka kwatanta da abin da ya saba faruwa, wanda shine muna tattaunawar biyun.

Bugu da ƙari, Bailey ya lura cewa 'Yan Australia suna amfani da Apple Pay sau da yawa fiye da abokan ciniki a kowace ƙasa. A halin yanzu, fiye da 26% na abokan cinikin ANZ suna amfani da dandamali.