Apple has had one of the "most interesting" weeks that we remember in recent years, however, it is good for us to keep in mind precisely that the vast majority of these presentations are due to digital products, software or services, one of the markets where the Cupertino company is growing the most.

This time we want to tell you about the new Apple Card, a credit card with which Apple aims to help us manage our finances and improve the performance we get from our money. Stay with us to find out everything you need to know about Apple Card.

However, and before we spend a good time talking about the details, it is important to know that this card will be available mainly in the United States of America, and that although an expansion to the rest of the market is planned, for now it is not is available in Spain or Latin America, however, it is a good option to get to know this product before it reaches our territory in order to be well informed about it and receive it in good condition.

What exactly is the Apple Card?

Basically We are in front of a credit card, it does not have more complications. You might even think that this Apple Card is actually completely digital, but it is not, when you register your Apple Card, a physical card is sent. This is perhaps somewhat contradictory considering that Apple owns one of the most popular mobile phone payment systems in the world, so much so that it even has its own payment platform accepted in many online stores. However, this physical card that Apple will send you will allow you to make payments in any condition, depending on the adaptation of the dataphones, for example.

This physical Apple Card that they will send us will be made of nothing less than titanium, so we are going to ensure its durability. In addition, to personalize it for each user, it will have the user's name recorded, not printed, so it will be completely unalterable. So far everything normal, since physical credit cards must have the full name of the user, the signature, an expiration date, its own numbering and the secure code that makes it theoretically insurmountable. Well no, the physical Apple Card will contain no other data than the user's name. That is how easy we will also be able to have a physical card with the famous bitten apple, how ironic.

What provider is the Apple Card and where can I use it?

To expand the Apple Card, the Cupertino company has made an agreement with the famous brand MasterCard, which together with VISA and American Express is one of the most popular. This will have depended on the most favorable commercial agreements for both companies, so we should not be surprised if we are more familiar with VISA or American Express as providers of this type of services. Therefore, now comes the important thing, where are we going to be able to use our Apple Card?

The Apple Card is a physical credit card, so we will be able to use it in all those payment devices implemented in stores that accept MasterCard, as well as in online points of sale that meet the same conditions. This Apple Card will include, as it cannot be otherwise, an NFC chip that will allow us to withdraw money at ATMs adapted to contactless technology as well as make payments on compatible dataphones, just as we would with our traditional cards. For more extreme cases, the Apple Card also has its own magnetic stripe.

How can I get my Apple Card?

Apple is going to implement a request form within the Wallet application, where it will be integrated once accepted and while they send us our physical card. To do this, we simply have to enter the Wallet application of our compatible iPhone and complete our data by clicking on the upper right corner of the screen, where we see the "+" button.

Once this form has been completed, and How could it be otherwise, our credit and delinquency history will be checked to verify if we meet the requirements, so maybe we should wait a little bit. Although Apple has not given much information in this regard and ensures that the procedure will not take "more than a few minutes", the reality is that all credit products of this nature require a prior study, which may be computerized based on databases such as ASNEF available in Spain, something that already happens in the Apple Store when you request financing, in which case it does not take more than a few minutes to know if we are accepted or not.

What are the advantages of the Apple Card?

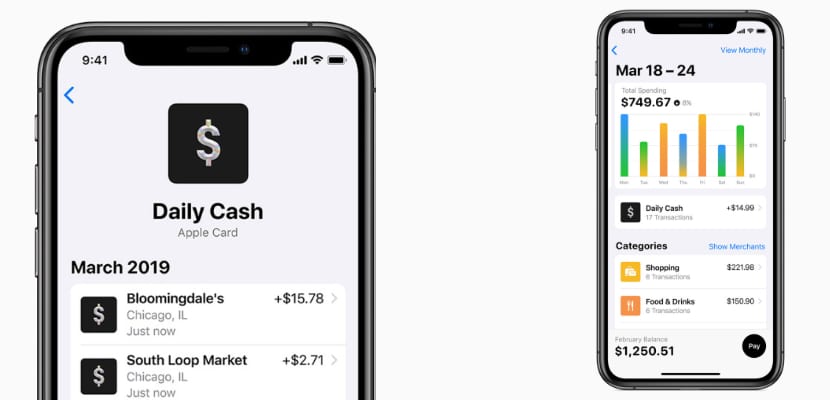

Apple will integrate, thanks to the Apple Card, a monitoring system of our finances where we can see not only what we spend money on, but also how we spend it, to improve our financial information and above all help us save as much as possible. This is the way Apple wants thanks to these monitoring functions highly similar to those of the "Activity" application, show us how much you can help us get the most for our money, but it also has some added benefits.

- 1% refund of everything you buy with the physical Apple Card

- 2% refund on everything you buy with the digital Apple Card

- 3% refund on all Apple products purchased with the Apple Card.

This refund will have a daily limit that the credit institution will adjust to the needs and possibilities of each user.

What is the "fine print on the Apple Card?"

Obviously, this type of card carries responsibilities, when we have a negative balance, payment delays or an increase in fees due to exceeding the credit limit. We are going to pay an interest that will be between 13% and 24% depending on the solvency of each user. However, Apple assures that no financial penalties will be imposed due to these delays beyond the interest earned for the late payment.