As you well know, Apple Pay grew timidly last week, first the German company N26 announced that before the end of the year (the last time Tim Cook said that we were until December) their cards would be fully compatible with Apple Pay in Spain. This is how the Boon signature. decided it was time to launch their payment system contactless in Spain before more competitors joined the event.

We've been rushing to get our Bonn card for a few days. with the intention of testing one of the few systems compatible with Apple Pay in Spain, and more this, totally virtual and with very few ties. We are going to tell you what our experience has been these first days with Boon. and if this alternative is really worth it.

The real shame is that the only "big bank" in Spain compatible with Apple Pay is Banco Santander, and it is not exactly one of the cheapest we can find. That is why Apple Pay has been frozen dramatically in Spain, despite the fact that Carrefour Pass offers many facilities, having to process the whole thing, and almost receiving a financial investigation by its employees, "throws it very back" to the users.

We started with Boon. almost without knowing her

We heard about N26, a bank that the editorial team of Actualidad iPhone Yes, he knows, and immediately Boon arrived. to promise us many facilities when using Apple Pay. As a lover of digital and mobile, I was quickly drawn to it. I have to comment that my main accounts are managed between Imaginbank (digital subsidiary of CaixaBank) and Bankia On (the digital version of Bankia), so I did not expect to be faced with any surprises.

The first steps with Boon. they were pretty easyNothing is further from downloading the application and including the information they ask for, little more than the phone, an email account and a DNI. Something was beginning to be strange, lovers of simplicity, but perhaps too much. Once the registration is completed, you will find a screen that indicates your balance and few more possibilities for customization. The next thing you have (even if you don't have a balance) is a card that quickly integrates into Apple Pay for the iPhone and the Apple Watch.

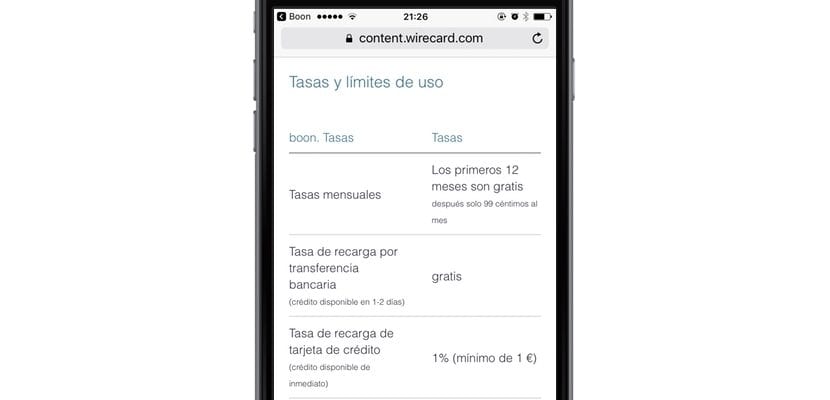

You stand a bit thinking ... When will they ask me to sync my credit card or bank account? This is how Carrefour Pass works for example, you assign it to a bank account and everything is automatic. Boon. It is not, if you want it to work you have two options: You make a transfer to a bank account that they have assigned to you, with the consequent delay in the balance; Or you link a physical credit card, to which a 1% surcharge will be assigned to each transaction you make (with a minimum of € 1 per transaction). Just thinking that they will charge me one euro for each transaction makes my hair like spikes, being a lover of contactless payment as I am.

We have made up our minds, we proceed to use Boon.

We are already clear about the recharging method that we are going to perform, the one in Boon. recognize how "Handbook", Since paying € 1 for each transaction does not seem attractive to me, I could get to suppose around € 30 per month. We propose to make the necessary transfer to add balance to our Boon account. and we find the first obstacle, not only will it take between 24 and 48 hours (like any transfer), but we will have to make an international transfer to a bank account located in Germany. Be careful here, because not all banks allow free international transfers, in my case my banks do allow it, so I make the first test transfer.

Another point to keep in mind is that we will consider 24/48 business hours, making a transfer on Thursday afternoon will probably mean that we will not see the money until Monday morning. We can confirm that it is.

Now it's time to make the first payment, our Boon Master Card. It is added to our Apple Watch and our iPhone, and the reality is that it works as it should, with the iPhone locked we press the Home button twice quickly and appreciate how the credit card is launched, we just have to place our finger on the Touch ID and bring it closer to the NFC-compatible dataphone to pay with Apple Pay, it works as expected from the system, both on iPhone and Apple Watch.

Is it Boon. a real option or are there better alternatives?

Of course, for those who are not a Banco Santander customer, the only two alternatives are Carrefour Pass and Bonn. The difference is that the Carrefour Pass is not granted to just any user, in fact they will carry out a prior financial study. That is why many users may choose Boon. as the only possibility. However, having the option, Carrefour Pass is shown in the absence of more interesting banks as the ideal alternative to use Apple Pay. The problem is that it is not a very comfortable alternative, unless you are willing to pay for each transaction or constantly wait for transfers, Bonn. It is hardly attractive. That is why I continue to position Carrefour Pass as the true alternative for those in Spain who are interested in using Apple Pay, however, Bonn. It is easy, fast and without obligation, that if, too uncomfortable, they do business with Apple Pay, and a business too succulent.

The current state of Apple Pay in Spain

Shameful is little for what we can say about itNeither BBVA, nor Caixa Bank, nor Bankia ... almost no powerful bank is willing to go through Apple's ring, nor the Cupertino company to give in its claims, which is clearly affecting users. But we must also point out other components such as the EMT and various public services that have NFC cards but have not included their systems in Apple Pay. Spain is still light years away in this technology and it does not seem that they want to do anything to solve it.

If your bank has free transfers to Spain, it also has them to Germany. Mandatory, as the word "international" does not exist among transfers from European Union countries. It is considered a single country (SEPA), Single Euro Payments Area.

If you have Spain free, it means Germany free.

If you do not have free to Spain, you do not have free to Germany, but in this case, the cost would be the same as what they charge you to transfer to Spain.

A greeting.

Thanks for the clarification Javier.

You are not clear about "€ 1 per transaction" ... I understand that every time you add a balance to the account, if you use a credit card, they charge you 1% of the amount you add to your balance, with a fixed minimum of € 1!

As you explain it, it seems that every time you make any purchase and use Apple Pay with boon they will charge you € 1

Indeed it is as you say it! =)

I do not find anything easy or attractive, it is clear that Spain is an Android country.

My Carrefour Pass suits me in luxury. Very easy, 100% free and above all, it is a MasterCard card with better conditions than those of the bank (BBVA in my case).

Asking for it is not that difficult either: you have to go to the Financial Services of any Carrefour and in 10 minutes you have it ...

The truth is that I do not see buts ... I even canceled my bank credit card.

True BENITO, I also have CARREFOUR PASS and it is also luxurious for me. The procedures are simple. The Spanish banks are useless, they do a lot of damage to the Spanish

Good article. Although you should rectify the part in which you say that they will charge 1 euro per transaction and that you could pay 30 euros per month for it. What you pay is 1% of what you transfer to your balance, with a minimum of 1 euro, which is enough. Thank you.

Good.

I've been using boon for a few months now (first with a UK account, and recently with an Italian account, to be able to operate in euros), and the "1% card recharge" condition has never been applied to me.

If I recharge € 50, they charge € 50 and € 50 increase my balance. And it does not matter if it is € 50, € 20 or € 100.

I do not know if it is something specific, promotional or whatever, but the fact is that they do not charge me.

I do not know if the author of the article has tried to recharge with a card.

I have made an automatic recharge from a credit card worth 100 euros. At the moment they have not charged me the commission, although I would not rule out that they do.

I have tried it and they only charge you € 1 if it is with a credit card, if it is with a debit card they do not charge that euro of commission.

So if you add balance with a debit card (as was my case), NOTHING IS PAID

Good: as Jorge indicates, if you add a balance using the debit card they do not charge you commission and you have the money instantly.

All the best